Utah Property Tax Map – What Is Property Tax? Property tax is a levy imposed on real estate by local governments, primarily used to fund public services such as schools, roads, and emergency services. Mo . The percentages vary by each county or tax district. According to a recent article by Rocket Mortgage, Utah has the 12th-lowest property taxes in the country, with residents paying an average of .

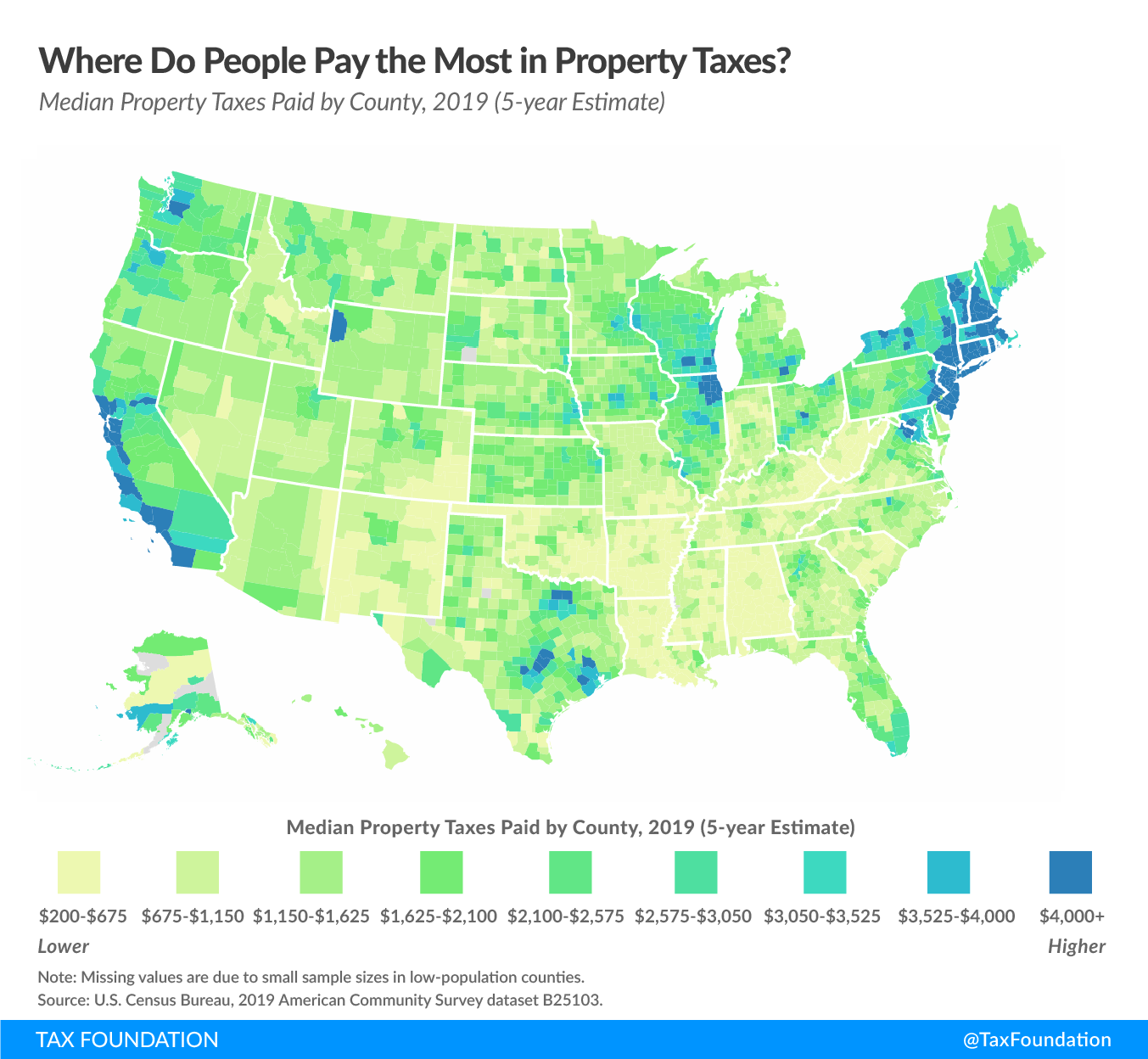

Utah Property Tax Map

Source : taxfoundation.org

Property Taxes by County | Interactive Map | Tax Foundation

Source : taxfoundation.org

Property Taxes by County | Interactive Map | Tax Foundation

Source : taxfoundation.org

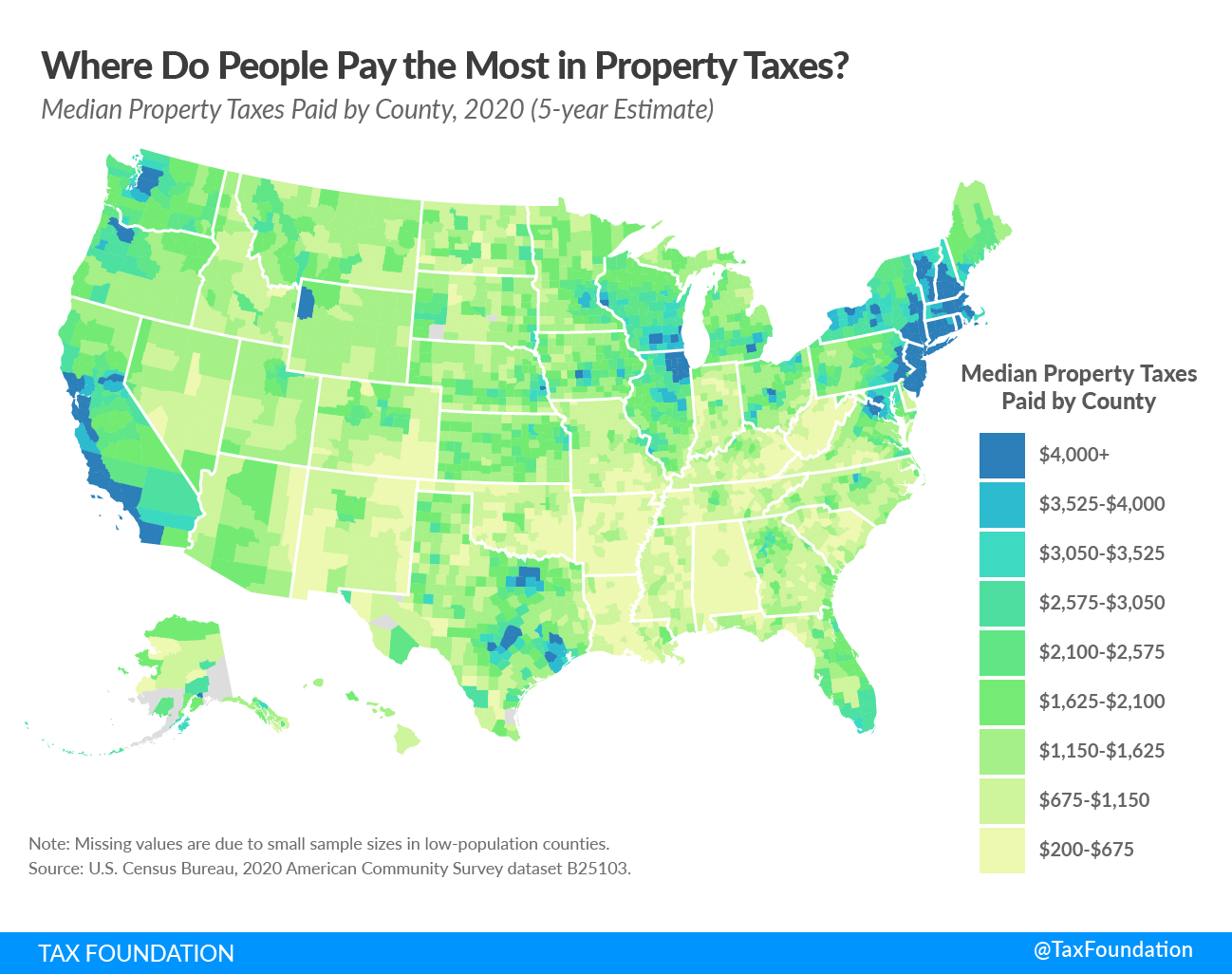

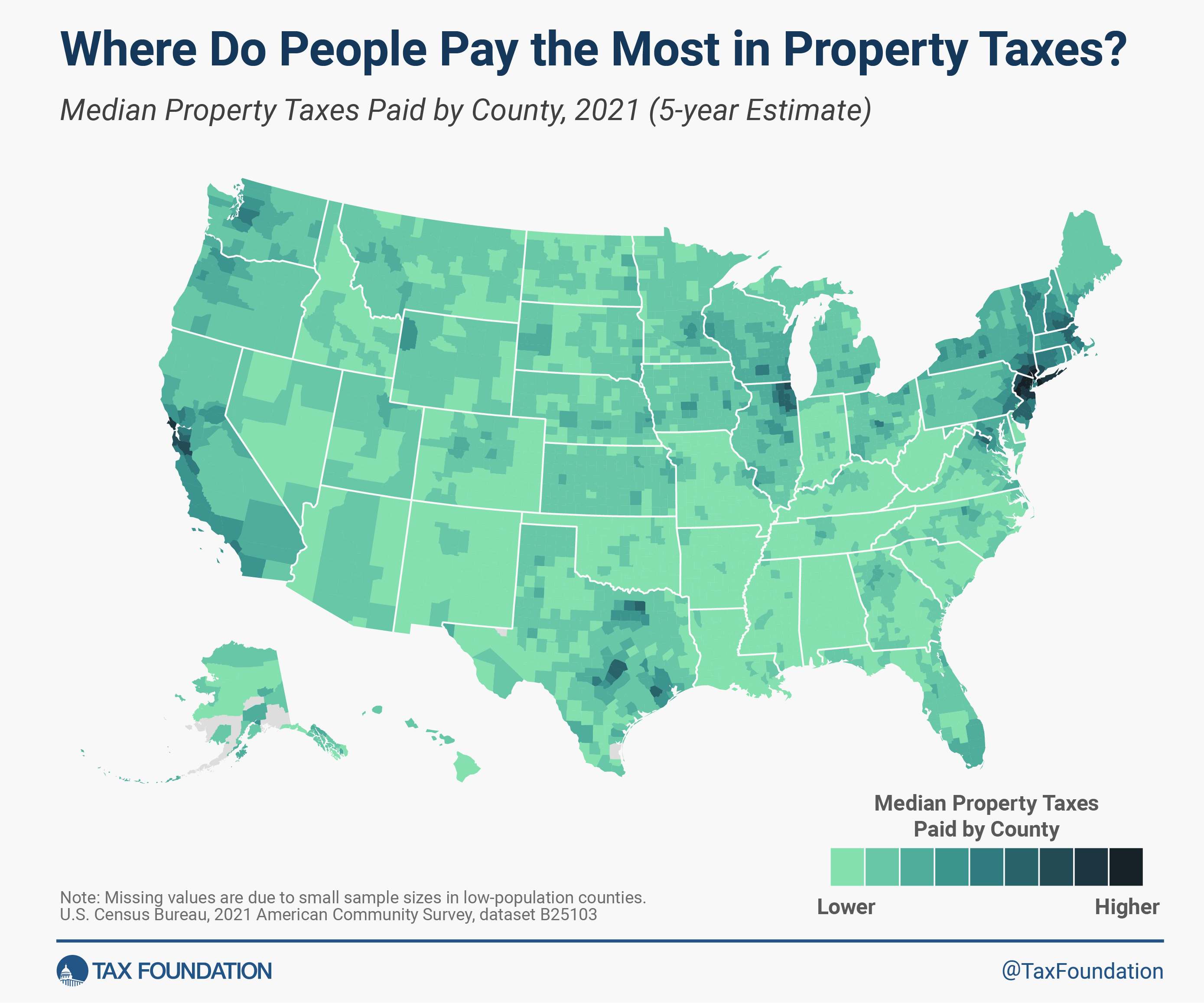

Property Taxes by State & County: Median Property Tax Bills

Source : taxfoundation.org

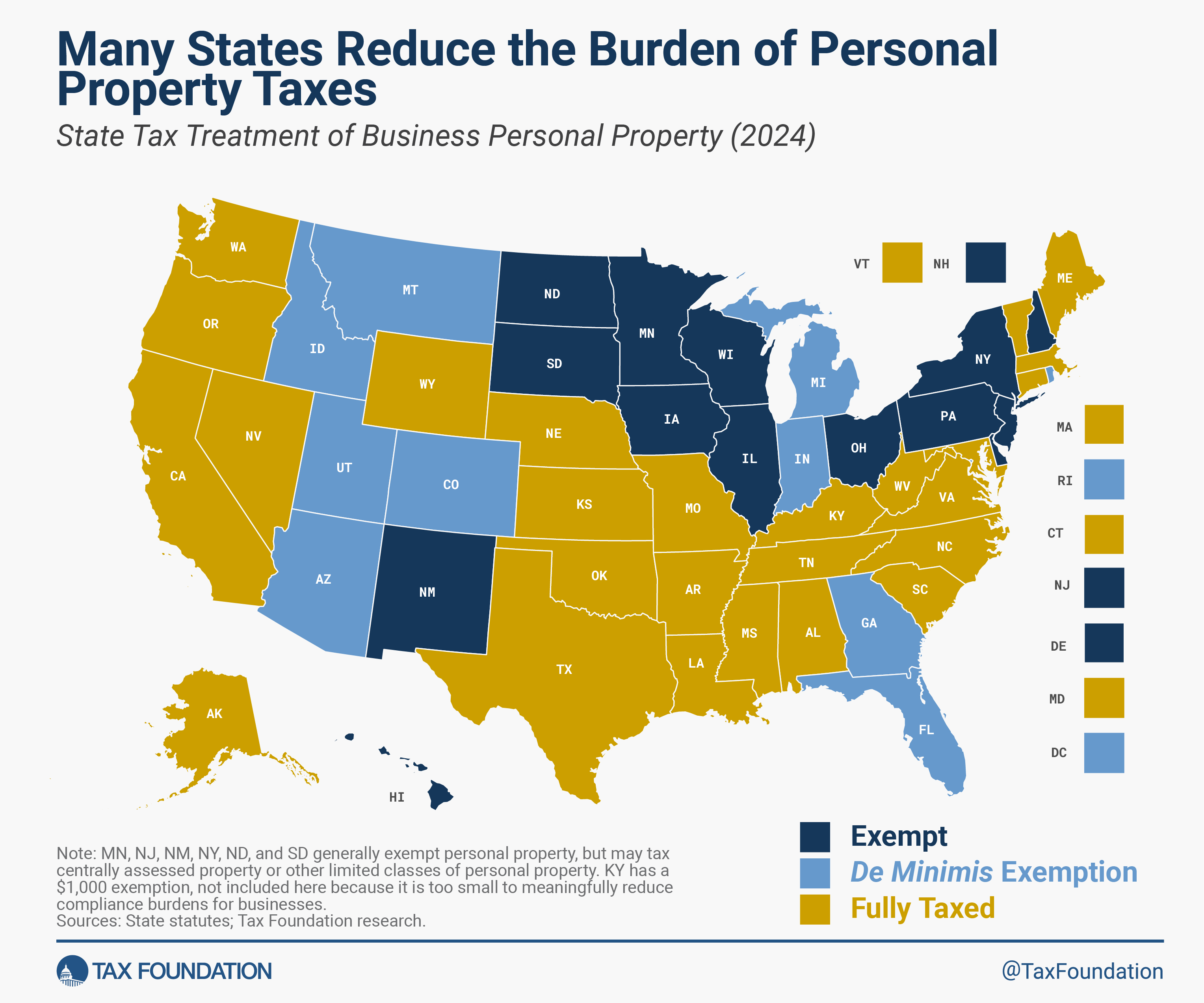

Treatment of Tangible Personal Property Taxes by State, 2024

Source : taxfoundation.org

Ranking Property Taxes by State | Property Tax Ranking | Tax

Source : taxfoundation.org

Property Taxes by State & County: Median Property Tax Bills

Source : taxfoundation.org

Official Site of Cache County, Utah Interactive Web Maps

Source : www.cachecounty.gov

Property Taxes by State & County: Median Property Tax Bills

Source : taxfoundation.org

National Register of Historic Places listings in Utah Wikipedia

Source : en.wikipedia.org

Utah Property Tax Map Property Taxes by County | Interactive Map | Tax Foundation: The Utah County Commission held a Truth in Taxation public hearing on August 15 to discuss an increase in Utah County property tax. Utah County is proposing a $7.63 monthly tax increase (or $91.56 . Definition: Property tax is the annual amount paid by a land owner to the local government or the municipal corporation of his area. The property includes all tangible real estate property, his house, .